Small Business Taxes

Few things are as rewarding as extensive government paperwork at both the state and federal level – especially when most of it means more checks for you to write. Small business taxes are, however, a reality of entrepreneurship, and not something you want neglect. Inform yourself, be as politically active as you wish for whichever side you choose, but in the meantime… pay your small business taxes. You’ve got too much invested to sacrifice it all over red tape and political frustration.

There are several different ways to handle business tax preparation. Many small business owners find it worth a little extra expense to utilize any of the qualified business tax services found pretty much everywhere. Small business tax accountants are specialists in both federal tax law state and local variations applying to your circumstances. Plus, when you utilize local small business tax services, you’re supporting other small local businesses like yourself.

There’s also an impressive selection of small business tax filing software options – everything from basic online forms to full service packages that ask you a series of questions and work out what forms you need and what additional questions to ask based on your responses. These can be wonderful time savers and they’re updated each year to reflect any changes to business tax legislation or deadlines. Most can handle state and local tax codes as well, although the more they do, the more they’re likely to cost. Business tax software is often a reasonable compromise between the doing your small business tax preparation by hand and hiring professional business tax services.

You can, of course, sit down with paper forms and work through it yourself. On the surface, this may seem like the least expensive option – and technically it is. It’s rarely the most cost-effective, however. For a relatively minimal investment in small business tax filing software, you could dramatically reduce the hours spend on sorting out your small business taxes. For a higher investment, you could have the expertise of small business tax accountants combined with the personal touch of being able to pick up the phone and ask questions or seek advice throughout the year. Either one allows you to get back to your own business instead of trying to pretend you’re an expert in someone else’s profession.

Unless, of course, you ARE a local tax preparation business. In that case, you can probably handle your own taxes. We hope so, at least.

As individuals, we pay dozens of different sorts of taxes – some obviously labeled as such, and others a bit more subtle and woven in to other things. Small business taxes are a bit harder to ignore, since as a small business owner, you’re typically responsible for collecting or paying most of them. Here are some of the most common small business taxes you’ll deal with as you grow your business:

If you have employees, you presumably pay them on a regular basis. It’s up to you to withhold appropriate income taxes (both federal and state) from each check, as well as Medicare and Social Security (FICA) contributions. You’re obligated to match those Medicare and Social Security contributions, so you’ll need to handle that part as well.

Additional deductions for health care benefits, retirement packages, additional investments, union dues, charitable contributions, or other recurring calculations aren’t taxes themselves, but they may impact the amount of tax deducted.

We’re all familiar with sales taxes, although we don’t focus on them the way we used to when paying cash was more common. (No one wanted to realize at checkout that we didn’t actually have enough to cover what we were buying because we hadn’t allowed enough for sales taxes.) If your small business sells goods or services, you’re probably expected to collect sales taxes.

These are one of the few things not currently collected at a federal level, but don’t worry – in addition to whatever the state demands, many counties have their own sales taxes for which you’re responsible. (You wouldn’t want things to become so simple they got boring, would you?) This means that the way your business sales tax must be computed not only varies from state to state, but often from county to county as well.

Generally you’ll collect and record these at point-of-sale each time. Even if for some reason you choose not to do things that way, your business will be expected to pay the appropriate amount of sales tax based on gross receipts, no matter how they’re computed or whether the customer knowingly paid their portion or not.

These are less common, but if your business involves specific products or supplies, you may be required to pay specific excise taxes in addition to typical small business taxes. Many are similar to what are sometimes called “sin taxes” – alcohol, tobacco, and gambling usually require specific excise taxes to be paid. Anything related to fuel or other petroleum use, including trucking and some manufacturing, often incurs excise taxes as well.

When you work for someone else, your employer deducts your federal and state income taxes for you. If others work for you as your employees, you’re responsible for deducting their income taxes. When you’re self-employed, with or without employees, you have to pay your own income taxes.

How your business is structured determines what sorts of income taxes you’ll pay and how.

One of the complicated parts of business tax considerations is that much of what dictates your small business taxes depends on how your company is structured. Business structure determines who makes the final decisions necessary to running the business, how profits are handled, and liability in case something goes wrong. The legal structure of your business also determines how taxes are calculated and who’s responsible for paying them.

This is a structure in which you are the business and the business is you. You make all of the decisions, you control all of the profits, and you eat any of the losses or liabilities. Taxes for a sole proprietor aren’t dramatically different than what you’re doing as an individual taxpayer already. Your business income is taxed at your personal income rate, the same as if you earned it working for someone else. When the potential profits are all yours, so are potential losses and debts incurred along the way, along with legitimate business expenses, payroll, etc. The paperwork can get complicated rather quickly. If you’re a sole proprietor, you’ll most likely use a form called the “Schedule C” in addition to your standard Form 1040 when it’s time to do your taxes. (Like any other required forms, the Schedule C is generated automatically when you’re using tax software and it realizes you need one.) It’s essentially a worksheet for determining your official profits for the year. You itemize business expenses and allowable deductions and subtract them from your total income. The Schedule C is where you fill in that mileage you’ve been tracking all year, and those lunches with clients, and the cost of office supplies, and that subscription to the industry journals, and so on. It’s important as well to fully identify various forms of business revenue – from sales, service, rentals, investments, and to distinguish between taxable assets and any unrelated business income. It’s easy to overlook important details, which is where the right business tax preparation software or local small business tax services can come in so handy. Sole proprietorships are also responsible for paying self-employment taxes. That means filing a Form SE – one of the rare times the name of government paperwork makes some logical sense. These are essentially the same taxes you’d have deducted from your paycheck if you worked for someone else. They’re currently around 15%, but as with anything managed by a government, the devil is in the details. It sure would be nice to have a versatile, affordable option for simplifying and organizing your small business taxes – something that would remind you of possible deductions for medical expenses or offer tips on minimizing the chances of an audit. Something accessible from your desktop computer, cell phone, tablet, or any other connected device. Unless you actually run a tax preparation business yourself, or you simply enjoy taking hours and hours away from your actual passion to do paperwork and don’t mind paying more than what’s legally required because you overlooked key deductions or completed the wrong box. Either way, small business taxes for sole proprietorships are usually payed quarterly, rather than once a year as with most individual tax returns.

As the name suggests, partnerships are run by two or more people at the same time. There are different types of partnerships, including that “general partnership,” the “limited partnership,” and the “limited liability partnership.” It’s important to note, however, that within each of these are endless variations. It all comes down to what’s spelled out in the partnership agreement everyone signs. General partnerships are taxed in much the same way as sole proprietorships. They require the same basic paperwork plus a form or two extra, and partners pay self-employment taxes just as if each were a sole proprietor (but only claiming their share of the total income). In a limited partnership, one partner holds more influence than the other(s) and carries the bulk of the liability for any debts or other things. The unlimited liability partner claims business profits as income just like a sole proprietor and pays self-employment taxes. The other partner(s) receive compensation in the form of distributions, which are different from getting a paycheck and have their own tax rules. Since this doesn’t apply to a majority of small business situations, we won’t go into it here. It is doable, however – especially with an affordable and intuitive set of tools for doing your own small business taxes. As we inch closer to actual incorporation, the next structure to consider is a limited liability partnership. Under a general partnership, all partners make decisions and all partners are liable. With a limited partnership, one partner has more decision-making power but is also largely individually liable for the results. In a limited liability partnership, all partners are protected from personal liability. They retain the tax advantages of being sole proprietors but can usually only lose what they have put into the business. Partners will pay self-employment tax as well as quarterly taxes.

The C Corporation structure has an even clearer line between the company as an entity and the individuals running it. This format provides better protection for owners should things go south. C Corporations require more paperwork and C Corporation tax preparation can be rather complex as well. That is, complicated if you’re doing them yourself without the help of local small business tax accountants or quality small business tax filing tools available online through any connected device whenever and wherever proves most convenient for you. Profits from C Corporations are taxed twice – first as business profits and secondly when shareholders file personal tax returns. The double taxation is the reason why many smaller businesses avoid this structure and create LLCs or S-Corporations instead, if practical to do so. Employees of C-Corporations are subject to withholding and do have to pay income tax just like everyone else. Stockholders are also required to report income from dividends separately.

Most of what we’ve talked about so far are business structures that impact how taxes are paid. The S Corporation isn’t a distinct type of business structure, but a specific way to manage small business taxes. Under an S Corporation structure, profits are taxed only as income – much like they are for sole proprietors or general partners. Those participating are responsible for self-employment taxes. The S Corporation retains the protections of a C Corporation with limiting personal liability for business losses. Because there are clearly numerous advantages to this set-up, the S Corporation comes with its own set of requirements and limitations which you can explore in more detail should you choose.

While there are times it might make sense for sole proprietorships to simply do their own taxes by hand, it’s usually not a productive use of time and resources compared to the power and affordability of modern small business taxes software and other online tools and resources. If your business is large enough to incorporate, however, there’s really no reason to handle your taxes unassisted by technology or local professionals. There are simply too many factors influencing corporate tax obligations, not to mention the endless variations mandated by your state or county.

For example, Nevada has what they call the “modified business tax.” It’s unique to the state and the official guidelines for anyone responsible for small business taxes describe it this way:

Every employer who is subject to Nevada Unemployment Compensation Law (NRS 612) is also subject to the Modified Business Tax on total gross wages less employee health care benefits paid by the employer. Total gross wages are the total amount of all gross wages and reported tips paid for a calendar quarter as reported to the Employment Security Division on form NUCS 4072. Exceptions to this are non-profit organizations, Indian Tribes, political subdivisions, and employers with household employees only.

It goes on for several pages from there, but you get the idea. If you’re wondering what the goal or purpose of the tax is, that’s in a separate official government release:

The Modified Business Tax (MBT) was established in Senate Bill 8 of the 20th Special Session in 2003 beginning in FY 2004 with an October 1, 2003, effective date… The tax base for the MBT is taxable wages, which is the sum of all wages paid by an employer during a calendar quarter to employees less allowable health care expenses. Wages are as defined in NRS 612.190, which relates to wages for the purpose of calculating unemployment insurance contributions under NRS Chapter 612. Allowable health care expenses are the same for both MBT taxes and are defined in NRS 363A.135 for the MBT-FI and in NRS 363B.115 for the MBT-NFI. Employer means any employer who is required to pay an unemployment insurance contribution pursuant to NRS 612.535 for any calendar quarter with respect to any business activity of the employer, except an Indian tribe, a nonprofit organization, a political subdivision or any person who does not supply a product or a service, but who only consumes a service…

Every state has quirks like this. Many have actual purposes for the hairy language in their tax codes, but in case it’s not clear by now, it rarely makes sense for you to wade through it in hopes of uncovering it. Better you spend your time and energy running your business and let the technology or the professionals (who largely use similar technology) do the grunt work.

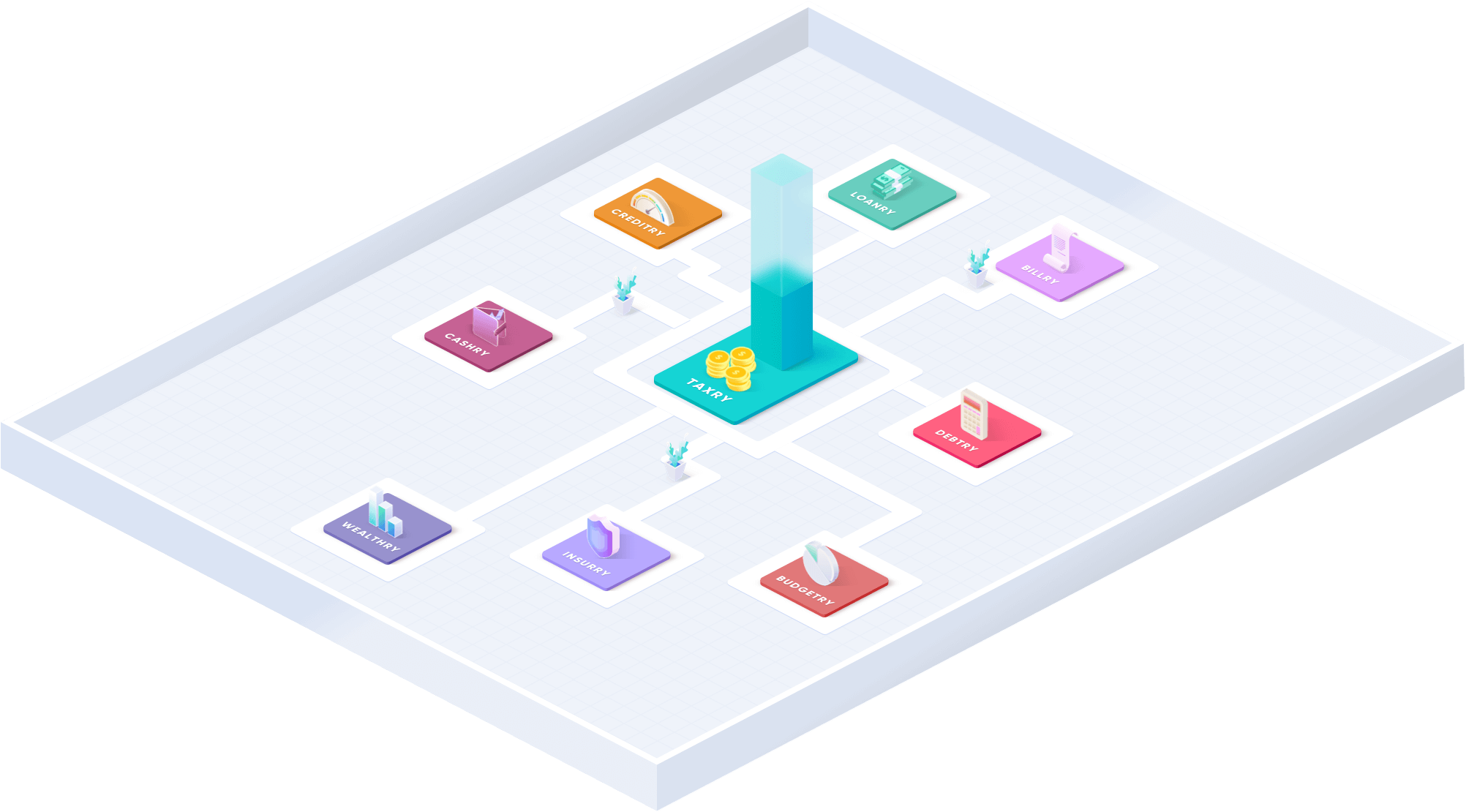

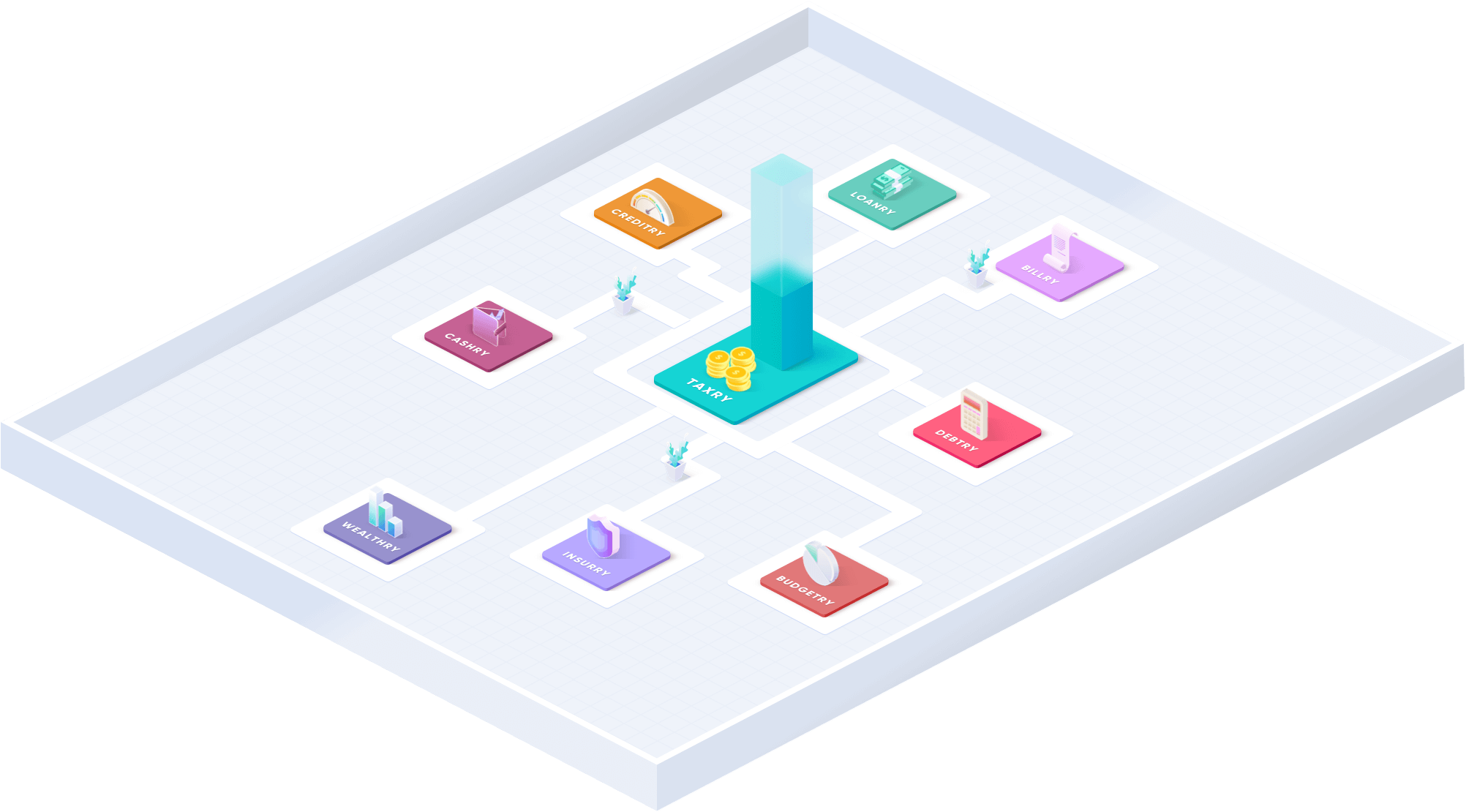

At Goalry, we have a vision some would consider overly optimistic. We believe that most people are quite capable of taking more effective control of their personal and small business finances – including savings, spending, debt, budgeting, and yes, taxes – if they’re provided with the information and tools to do so.

We’re under no illusion that small business taxes will always be easy, but as with so many things in the financial world, neither do we believe they must remain forever stay so complicated. We have the information, we have the technology, the pieces are all there. Sometimes we just need a little help putting them all together.

We’re re-imagining personal and small business finance and helping people much like yourself connect the different parts of their fiscal world in order to take more effective control and make better decisions. That includes simplifying small business taxes. If that’s the main thing bringing you here today, we’re glad you’re here. Browse our blogs and check out our resources. Check back soon for a leap forward in tax assistance technology. Big things are happening, and we’re excited to have you as part of that.

Please know, however, that joining us at Taxry gives you access to the entire Goalry family of unified finance. We don’t want to startle you or anything – we’re just letting you know it’s there when you’re ready to look around a bit more. In the meantime, let us know what we can do to help.

Where would you like to begin?