Tax Tools

Many of us have learned to dread April 15th every year (which made it extra weird when “Tax Day” was deferred to July 15th for 2020). The forms, the questions, the worry we’ll miss something or do something wrong. The anticipation if we expect a refund or the stress if we know we’ll probably owe. Taxes are serious business, to be sure, and no one likes paying them – but the grief we put ourselves through each year is largely unnecessary.

Nothing that happens on Tax Day should be a surprise. Any legislation impacting the tax code has already been passed long before the day itself arrives, and the paperwork has been posted and printed for six months already. We already know what we made the previous calendar year (or should) and we should have a pretty good idea how many taxes we’ve already paid. In short, Tax Day should be a formality and nothing more. Many people find it comforting to simply file their returns by late February or early March and simply be done with it. They no doubt get a good chuckle each year as the rest of us scramble around as if we had no idea it was coming – like our in-laws have shown up unexpectedly and plan on staying awhile and we’re out of milk and haven’t made the bed.

Some of you are wondering why you’d have any more time to deal with your taxes in March than you do in April. The answer is that you don’t start dealing with your taxes in March. Ideally, we don’t “start” dealing with them at all. With the tax tools and convenience technology available to us in this day and age, preparing for Tax Day should be as much a part of your daily (or at least weekly) routine as maintaining a household budget, categorizing your spending, monitoring you bills and investments, and managing your debt. If utilizing a tax manager throughout the year is as easy as checking social media or clearing the bars on your fitness tracker, why would you not? In other words, those folks who file long before Tax Day arrives and who never seem to owe anything but never get a huge refund either aren’t simply living a charmed life and may not be particularly lucky. Chances are, they simply do quick, simple things throughout the year to make sure they’re on track. Whether they use a spreadsheet for regular record-keeping and transfer the information into any of the amazing personal tax returns software available in the 21st century or utilize a tax tracker on their phone or other device throughout the year, they’re not working harder – they’re working smarter. And on Tax Day, they’re not working at all.

As you’re no doubt aware, most tax management comes down to filling the right information in on the right forms then doing some math and consulting some charts. Parts of it can seem complicated, but all of it’s tedious and detailed. Extremely organized people don’t mind as much – they’re masters of this sort of thing. I think they actually kinda like it. For the rest of us, however, it’s worth keeping in mind that detailed, repetitive, complex, or tedious data juggling is what technology does best. We haven’t yet found a computer program which can reliably diagnose the common cold or offer empathetic relationship advice, but the computational power of your cell phone or whatever video game console you have gathering dust in the den is literally thousands of times more powerful and precise than the technology that helped man land on the moon. It can handle your tax returns. Note that the computers on Apollo 11 weren’t making the major decisions that day – people did that. Your phone doesn’t decide who you should call or what you should regret posting or sharing on social media, and your video game console is unlikely to scold you for your game-playing strategy. Technology isn’t ideally suited to tell us what to do. It’s amazing, however, and being told what we want to happen and helping us make it much more efficient and effective than it would be otherwise.

There’s no reason in the 21st century that your tax management software shouldn’t be able to easily integrate with whatever other personal or small business financial management apps you choose to utilize. It’s great to use someone’s free tax calculator online (even the IRS has a fairly easy-to-use “tax owed calculator” you can use). There’s certainly nothing wrong with taking advantage of any of the popular name-brand tax tools out there to help with tax management once a year.

But…

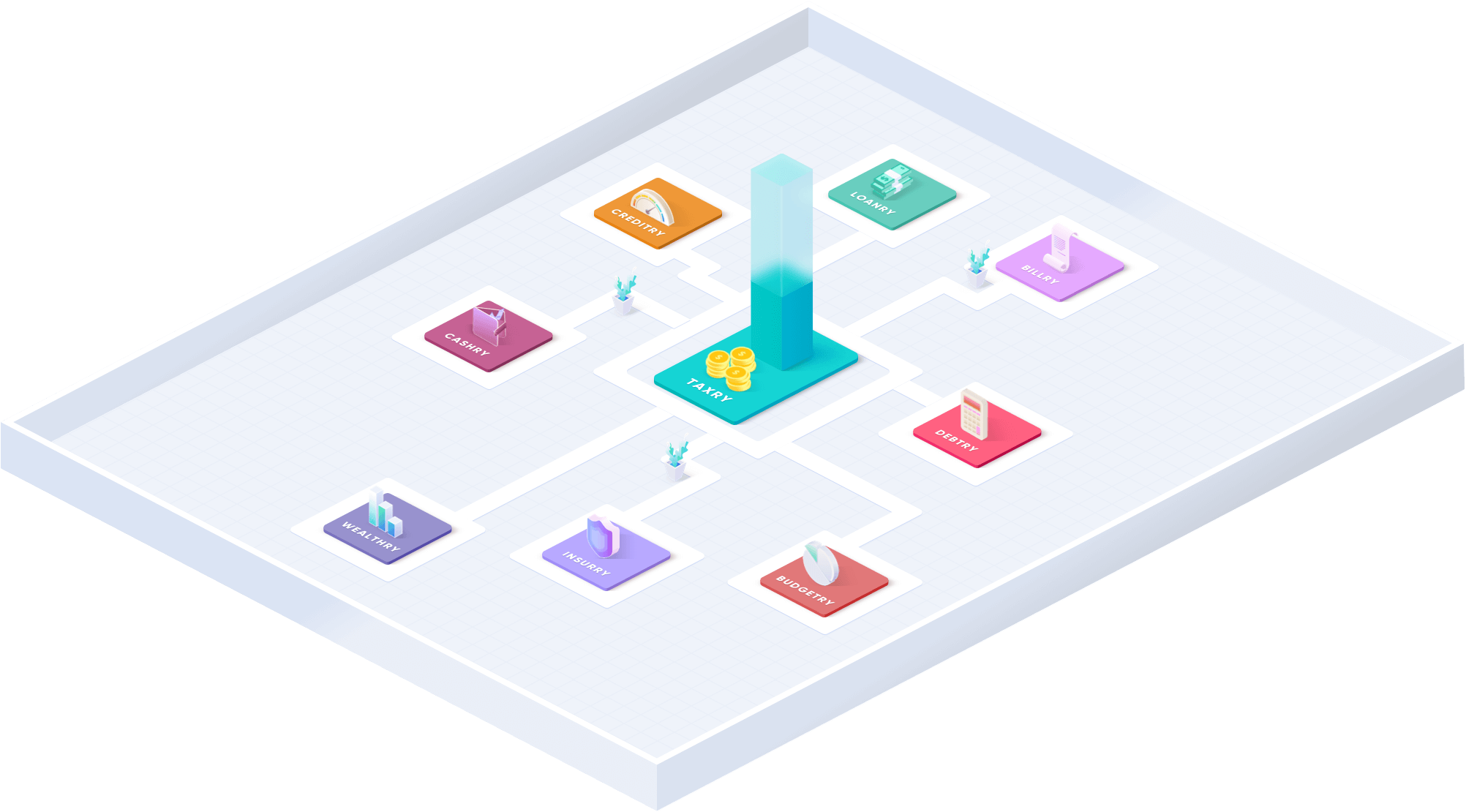

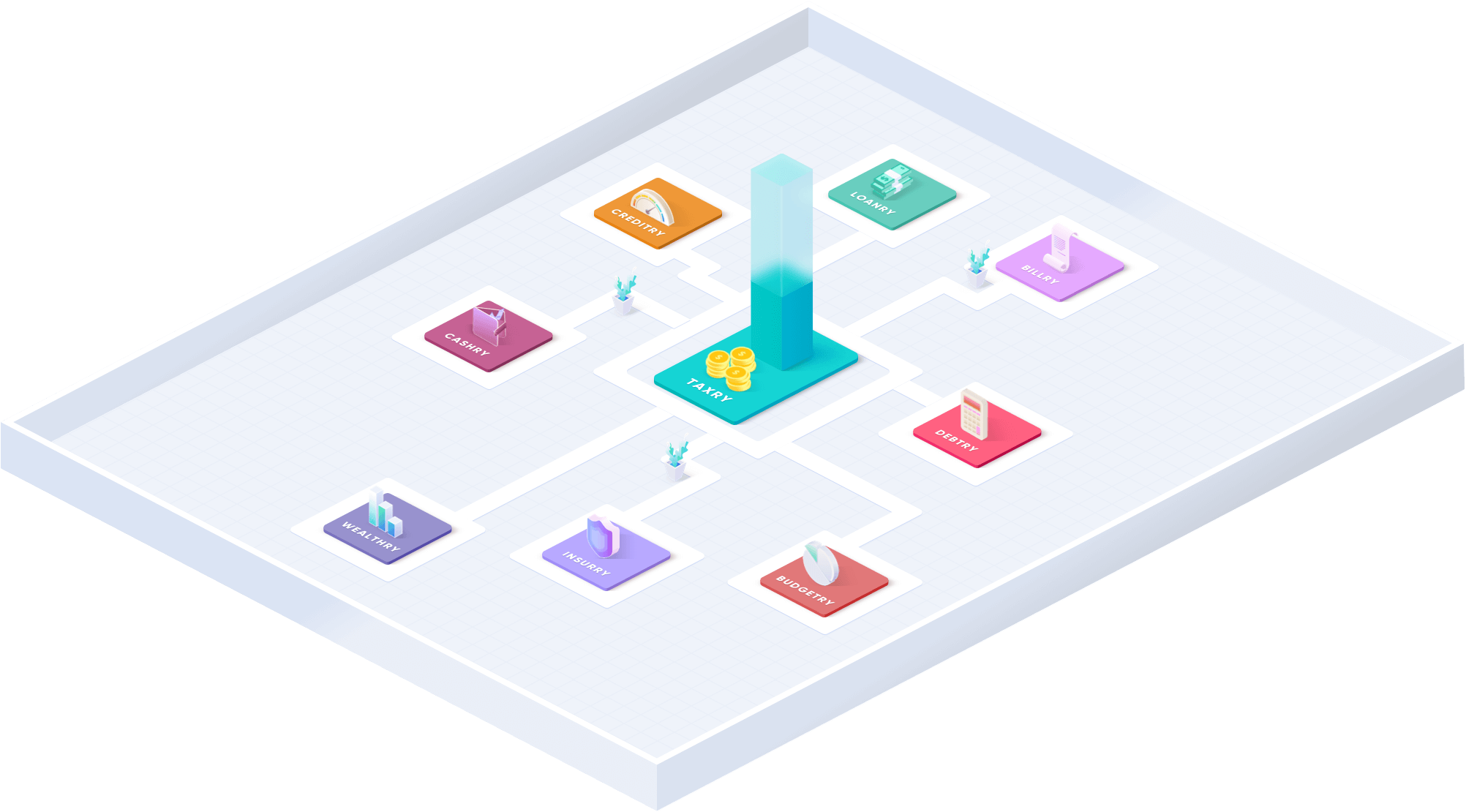

We have this crazy idea at Goalry that most people are quite capable of taking more effective control of their personal and small business finances if only given the right information, tools, connections, and opportunities. Part of taking that control is realizing that the different elements of our financial worlds don’t require the sharp separation we force upon them. Our savings and our investments are very much a part of our retirement planning and that’s impacted by our current and future debt and our credit scores and credit histories. Our taxes depend on our income as well as the value of any real estate we may own, buy, or sell, and our profits and losses can be dramatically impacted by the insurance coverage we select.

Money isn’t everything – nor should it be. It does, however, impact almost everything important in our worlds. It shapes our options and our ability to take care of the people we love. And it’s all the same money, just in different forms doing different things and sometimes operating according to different rules. Like matter and energy, however, it’s silly to pretend none of it’s related when it’s all very much part of the same story – ours.

Our vision is to simplify personal and small business finances through our informational blogs and videos and by facilitating connections between clients and members of our carefully curated database of financial professionals. We’re humbled and gratified by how well these parts are already going and how quickly they continue to grow. The feedback we receive has been amazing and we’ll certainly keep doing everything we can to earn it.

The next step is to put tools for managing all aspects of personal and small business finance into the hands of anyone who wants them, to use separately or in combination, across the spectrum. Powerful enough to adapt to your specific circumstances and intuitive enough that you don’t have to take a course in how to use them. Unified finance, re-imagined. We’re taking the time to get it just right, but we couldn’t be more excited.

And then there’s “miscellaneous income.” If you’ve done any consulting or freelance work, or received any other types of income not from a traditional employer, you should receive a Form 1099 for each. There are over a dozen variations of this, including the 1099-A (acquisition or abandonment of secured property), the 1099-B (proceeds from broker and barter exchange transactions), the 1099-C (cancellation of debt), the 1099-DIV (dividends and distributions), the 1099-INT (income from interest), the 1099-Q (payments From qualified education programs under Sections 529 and 530), the 1099-R (pensions, annuities, retirement or profit-sharing), and everyone’s favorite, the 1099-MISC (miscellaneous income).

Seems like we could have just gone with that one for everything, doesn’t it?

You are responsible for reporting miscellaneous income whether you receive a 1099 or not. If you came out ahead at the slots or card tables, won any substantial cash awards, or got lucky with the lottery, keep in mind that the IRS almost certainly knows about it. If you don’t report it, they’ll assume you’re trying to avoid paying taxes on your winnings and the penalties can be stiff. Your average once-a-year garage sale doesn’t generate reportable income – partly because most of us don’t make that much that way but mostly because you’re selling items for less than you probably originally paid for them. If you do crafts or offer services like landscaping on the side, however, that might reach the threshold for taxable income. This is where a slew of “if X and Y but not Z” type rules come into play. A professional tax preparer or decent tax tools package would be able to ask you just the right series of questions to sort it all out for you – probably without you ever even realizing what a tangled mess the rules themselves sometimes are.

Some forms and requirements you’re only going to get once a year. You use them to file your taxes, then store them away in a file folder somewhere. Many other records, however, are about what you’ve spent, on what, where, when, and why. What you’ve earned. What you’ve saved. The miles you’ve driven or the donations you’ve made. Endless details of things that are generally simple and straightforward when you do them but nearly impossible to recall and round up a year later. Imagine categorizing your spending and other transactions with a few swipes or clicks in real time as you go, as easily as you check your text messages. Imagine multiple financial applications working together seamlessly so that the information you take a few seconds to store for your personal budget is also filed away for your tax returns and taken into account when you pull up your investment manager or retirement planner. It’s not like you’re doing more work to make all of these things happen. The technology is doing what technology does best – taking quick, intuitive human input then doing the rest of the work for you according to what you’ve told it you care about and what to happen.

Small business owners often complain that it seems like the tax system and other red tape is designed to prevent entrepreneurship rather than simply regulate it or collect reasonable taxes on its profits. If you’re in business for yourself – especially if you have employees and a location other than your home office – it’s practically essential that you take advantage of the many quality tax tools available or hire a local tax professional. There are simply too many things it’s easy to overlook, and you have better things to do than chase paperwork around all day. Much of the information required for tax time can be entered one time and forgotten unless something major changes. The rest is often much easier to manage week-by-week or month-by-month. If you’re a small business owner, you’re probably busy most of the time and don’t always keep up with everything you’d like. Imagine timely reminders each time you’d benefit from checking the information already stored and answering a few brief questions to make sure you’re on track. Letting your tax management tools do what they do best lets you get back to doing what you do best more quickly. Ironically, it’s not profits and losses that trip up many small business owners or prevent them from making the most of their legal deductions. It’s things like mileage – easy to figure if all you have to do is approve a few numbers with a swipe or two each time you arrive, but much harder to estimate accurately after months have passed. It’s meals with potential clients, which can only be partially deducted and in certain circumstances. Would you rather try to recall every lunch you had last year or let your phone or other device ask you a few quick questions and file the correct information away for maximum benefit down the road? Finally, most small businesses pay their estimated taxes quarterly. The right tax tools can make this as painless and as accurate as possible, and even remind you if the due date begins to approach before you’ve approved your estimated payment.

If you’re working out of a home office or using a personal cell phone or computer part of the time for your business, things can get tricky quickly. There’s nothing wrong with hiring a tax professional to help you sort it out, but imagine being able to simply respond to a few simply prompts once-in-awhile and then letting the tech do the real work of figuring out how to make the maximum use of those numbers within the confines of federal and state tax codes. The same could be true for charitable deductions, health care expenses or benefits, and whether or not the interest on your second mortgage is deductible. Let’s be honest – making your personal and small business taxes a bit easier to manage throughout the year is a huge stress-reliever for everyone involved, whether they’re part of the business or not. It’s worth saying again: let the technology do what it does best so that you can get back to doing what you do best.

Your full name and mailing address and the full names of anyone sharing or claimed on the return. Hopefully you can handle this part.

Your Social Security Number and the Social Security Number of everyone else listed on your return. One of the most common mistakes on returns – and thus one of the most common reasons a refund may be delayed – is that one or more required Social Security Numbers is entered incorrectly. If you or a member of your household doesn’t have a SSN, you’ll need your or their Tax ID number instead.

An accurate W-2 from every employer you or your spouse (if filing jointly) had during the year.

All financial statements related to savings, contributions, investments, etc. If you’re paying on student loans, you’ll have to file a Form 1098-E with your Form 1040. If you have a mortgage, that means a Form 1098. If you’re making contributions to an IRA, add a Form 5498 as well. Forgot to pick one up? Bummer – at least you can download one from the IRS website and print it out, right? What’s that? Printer’s out of ink? Hmmm… that’s not a problem when you’re using the right tax tools to do the paperwork for you.

Information from last year’s state refund, if you received one. This one catches a lot of people off guard even though it’s not new. It probably goes without saying that any good tax manager software or app will already have this information if you use it every year.

We can’t make life easy, especially when it comes to running your business or paying your taxes. But it doesn’t have to be as hard as it’s been, and you don’t have to do it alone.