Luxury Tax Explanation for Those That Can Afford the Unessential

Taxes are the subject that most of us are way more familiar with than we want to be. The unfortunate part is while we think we know all we need to know about taxes, we do not know as much as we should. I would bet that many of you have not heard of items such as luxury tax or gift tax. We know that we have to pay taxes with each of our paychecks and dread the looming of April 15 when it comes around.

Before you buy the next item you should read this article to have a luxury tax explanation.

What Is A Luxury Tax?

Here is the luxury tax explanation that you have been waiting for...a luxury tax is one that is found on products and services that are considered nonessential items. This is an indirect tax, which means it increases the cost of goods or services. In most cases, the tax is already added to the price of the item when it is on the shelf. So, you may never be aware of how much tax is added to it. It is only levied on you when you purchase the item.

Luxury taxes were often used during war time to help increase the money that the government receives. It is also a way to get more money from the wealthy that can afford to throw away money, in a sense. If you look at the number of luxury items that are bought and sold today, it would seem that many do not mind paying a luxury tax on the items that they really want.

Are the Items Really ‘Luxuries’?

The term luxury seems to be oddly placed here because they are not technically luxuries. Today these items are items such as tobacco, alcohol, jewelry, and high-end vehicles. Since these are the items that are considered luxuries, the thought is that over time more and more items may be deemed luxuries it may be extended to more items. What was at one time considered an ordinary good may be termed a luxury and taxed. Many of these taxes today are intended to collect money in taxes and change consumption patterns.

Is Sin Tax the Same Thing?

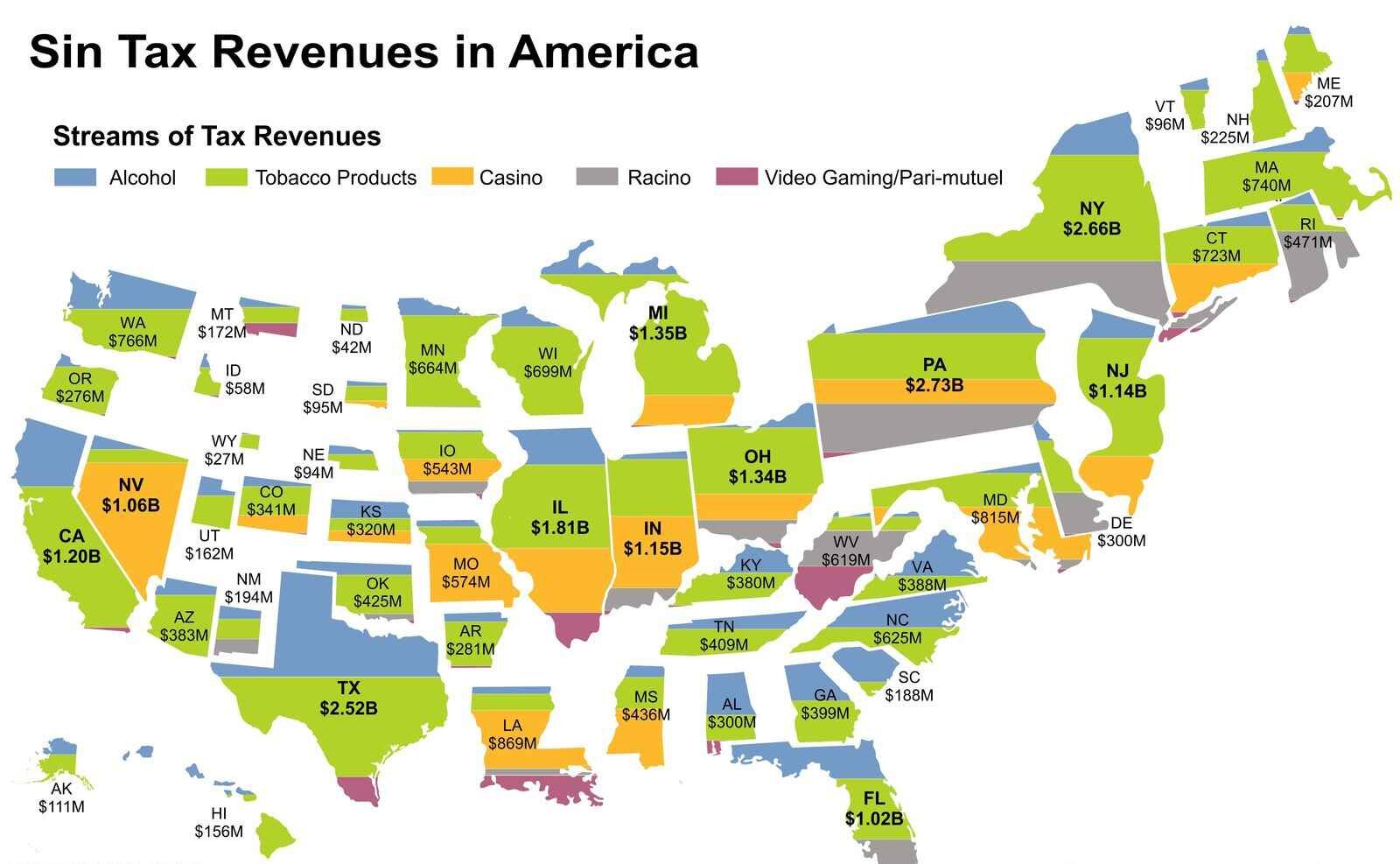

To further the luxury tax explanation, I want to address sin, or excise, tax. For all intents and purposes, all three taxes are the same thing, just called by different names. The connotation associated with a sin tax is that these items are not the best for you, so they are a 'sin' and going to be taxed heavily in an attempt to prevent you from engaging in the activity or consuming the goods. There are some that deem these items as harmful to society.

I am not here to get into a philosophical debate over whether someone else should determine if something is harmful. The main items that fall into this category are tobacco, alcohol, and gambling. These items are the ones that are considered the most dangerous to people and society. These items also bring in a large amount of revenue and as a result, I am sure it is no surprise that governments like these types of taxes.

In times when there does not seem to be a lot of spending or revenue generated by the states, they turn to these types of taxes. It is the easiest way to fill in holes in the budget. There is much criticism around sin taxes. There are some that feel that they are more harmful to the general public because it does not really stop the behavior, all it really does is encouraging the behavior. The government is accused of social engineering based on this type of taxation.

What Is A Gift Tax?

While this is a luxury tax explanation, it seems important to mention and explain gift taxes. A gift tax is when property is transferred from one person to another without receiving something of equal value in return. Or if the price paid for an item does not match the value. For example, when your brother sells you a car that is worth $50,000 for $5. That will raise alarms with IRS.

Other items that fall under the category of gifts is giving money to someone that is not your spouse. If you allow someone to use something for free that you would charge someone else to use, that is a gift and can be taxed. If you reduce the interest on a loan, or remove the interest altogether, it can be considered a gift.

There is a set amount that is excluded annually. If you stay under that amount, then it can be excluded. The amount for 2023 is $17,000. If you plan to give a gift, make sure you stay under that amount.

Need Help Preparing Your Taxes. Taxry Helps You Find a Tax Preparation Firm. Join Today!

What Happens When I File Taxes?

Now, that you have had some luxury tax explanation and gift tax, what does this mean at tax time. When it comes to the luxury tax, you pay that upfront every time you make a purchase. The gift tax, on the other hand, is something that comes up when you file your taxes.

Proving the Gift Tax

When you file your taxes, IRS is going to want to see proof of the gifts you provided to people. The proof that you can expect to show would be appraisals, transfer documentation, and documentation of any gifts that you partially gifted to anyone.

The IRS is going to want to make sure that the Fair Market Value is being reported properly. The Fair Market Value is the price that would be charged if the property changed hands between any buyer and seller that are willingly purchasing and selling the item while having reasonable knowledge of all facts. The basic gist of that is no one is being forced to buy or sell anything. When something is given as a gift, it needs to be appraised for its value.

This is similar to what happens with a house when you want to sell it. You only pay taxes on a gift if you are the giver of said gift. You also have to pay taxes if you sell a gift for a profit. This may all seem a little confusing, trying to determine when and if something is a gift. If you are uncertain about any items that might be considered gifts or have any other tax management questions, you should not hesitate to contact a professional who is better suited to answer your questions.

What Are Taxes?

Now, let’s make sure that you have an understanding of taxes in general. We all know that we get, what seems a large amount of money, removed from our paycheck for income tax. Yet, when we file our taxes, we still seem to end up owing money. I am not sure about you, but this is incredibly frustrating for me because I do not want to lose any money.

At its most basic level, a tax is a charge handed to you from the government. It is a fee that you are required to pay and you must not avoid paying it. Doing so will open you up to hefty fines and even a jail sentence. It is a serious offense not to pay your taxes. The IRS always finds out when taxes have not been paid. It may take them a few years, but they will come after you. They are many legal deductions that may decrease the amount of taxes you pay, but you must be sure to stay within the law when making those deductions.

Various Types of Taxes

Every single person and business is subject to taxes. There are many different types of taxes, such as property, sales, estate, and income taxes. You are taxed for these items are varying times. An income tax is associated with the money you earn that is as a result of payment for services rendered. There are different tax brackets that are based on the total earnings you have for one calendar year. The higher the tax bracket in which you fall, the higher the percentage of taxes you must pay. Everyone that earns over the limit set by IRS must file a tax return.

Why Do I Pay Taxes?

You know that you have to pay taxes but do you know why? Many people do not fully understand where the money goes when they pay their taxes, and everyone should have a good understanding of why and what happens with the money that you are paying. It has many uses that you probably have not even considered or realized.

It goes to pay the salary of government workers for many federal and state workers. The money goes to resources such as firefighters, police, and EMTs. These taxes also help build and maintain roads to ensure safe travel. The taxes also fund public libraries and parks, as well as funding government programs for those that are from a poor and lower socioeconomic background.

Taxes also go to many items such as science and medical research which helps funding cures for illnesses and to fund innovative find in research. It can also help fund education with can help make the cost of education more affordable for anyone to attend by funding Pell grants. It helps regulate public services such as keeping water and air clean and provide safe products and services.

How Do I Save Money On Taxes?

The simple answer that goes with the luxury tax explanation for saving money on that particular tax is to stop purchasing items that fall under that tax. That may be challenging because they are typically items that people want to purchase. If you fall into the “no one is going to stop me from buying the items I want” category, you may not be able to reduce the amount of money you spend at the checkout.

Buy Less

You could consider buying less of those items or buying them less frequently. For example, only purchase alcohol for special occasions, or once a month. Once you have an understanding that you are being taxed more heavily on these items and that is a tax that you can control, you may decide to take a more proactive approach and limit the amount of money you spend on these items.

Withhold More Money from Your Salary

You can also have more money withheld from your paycheck each time you get paid. If you have more money withheld with each check, you should not owe any money when you file your taxes. Your best bet is to break even or to owe the IRS a small amount of money. This way you are being taxed as close to the right amount as possible and you are not faced with a huge bill in the middle of April.

Can I Lower My Taxes?

After the luxury tax explanation, you may feel a bit disheartened about taxes. I totally understand that, but all is not lost. There are some tax saving tips that you could consider to decrease the amount of money on which you pay taxes.

Contribute to an IRA

One of the best ways to lower the amount of taxes you pay is to put more money, up to the limit, in your retirement accounts. As long as the account is not a Roth IRA, the money you contribute to your retirement account are tax-deductible. When you contribute to a 401K, that money is contributed before you pay taxes, so you never pay tax on that money. When you contribute to an IRA, the amount of money you contribute is deducted from your taxable income. It is a win-win situation for you because you are maxing out the money in your retirement account and you are reducing your taxable income. It is like you benefit twice.

If you do not currently have health insurance, you should get it. For one, you will be penalized for not having health insurance and have to pay a fee, so absolutely get it. Plus, in general, it is a good idea to have it. You also may have to pay more in state tax, depending on where you live, if you do not currently have health insurance.

Contribute to a 529

In addition to saving for your retirement, you could save for your children's college by putting money in a 529. While this will not help you with your federal taxes, you may be able to get a deduction on your state tax by contributing to a 529 for your children.

Should I Pay More Taxes Throughout The Year?

There are a few ways to have more taxes withheld throughout the year. If you end up paying a large amount of money at tax time, you might want to consider doing one of these two things to lower that amount. Please keep in mind this is not related to the luxury tax explanation.

One of the ways to increase the amount of taxes you pay is to increase your withholding amount. That means you will have less money in each of your paychecks. That also means that hopefully, you will have to pay less money when it comes time to file your taxes.

You can also estimate the amount of taxes that you think you have to pay at the end of the year. There are many tools available to you to help you estimate the amount of money you will owe. You can make payments quarterly based on those estimates so that you can pay enough taxes so when it comes to filing your taxes, you will not owe more money.

Conclusion

There is a fair amount of information in this luxury tax explanation that has to do with the luxury tax, however, some of it does not. All of this information is important for you to be aware of so that you know when you are getting yourself into tax time. There are many professionals available to help you if you feel uncertain or have questions.

When it comes to filing your taxes, you should not guess or think that you know the right thing to do. You should consult a professional with any questions that you may have. If you need a more in-depth luxury tax explanation, you should also consult a professional. There is not much a professional can do to help decrease the luxury tax that you pay. They can explain it to you a little more. If you do not want to pay a luxury tax, you will have to stop purchases that fit into that category.