How Does the IRS Know If You Give a Gift?

Updated: 2023/04/26

There are many tax requirements that you might not be aware of. Being unaware of certain tax requirements could cause you problems down the road. One example of a tax requirement that many people aren't aware of is gift tax requirements. In some situations, you may be required to pay taxes on a gift that you give. Regardless of whether you owe gift taxes, you may need to report significant gifts when you file your return.

You might wonder how the IRS could find out about your gift. It's a common question to ask how does the IRS know if you give a gift. It's always possible that the IRS will find out about a gift you did not report properly. If this happens, you could be subject to penalties and interest. Having a good tax tracker that helps you meet tax requirements is a good idea. It's also a good idea to research tax requirements for gifts before you give one.

The following is some key information on gift tax rules and how does the IRS know if you give a gift.

How the IRS Can Discover an Unreported Gift

One of the most common questions taxpayers have is how the IRS can become aware of gifts. You might assume that the IRS will never know about a gift you give. However, this is not necessarily the case. The IRS does have ways to track gifts that taxpayers give. It's true that they relie on the honor system to a certain extent when it comes to gifts. The IRS doesn't have as much power to track gifts as it has to track income. That being said, there are some ways that they can become aware of gifts.

The primary way the IRS becomes aware of gifts is when you report them on form 709. You are required to report gifts to an individual over $17,000 on this form. This is how the IRS will generally become aware of a gift.

However, form 709 is not the only way the IRS will know about a gift. The IRS can also find out about a gift when you are audited. Going through a tax audit can be stressful. You should understand what a tax audit entails.

Reporting Gifts on Your Tax Return

Most of the time, you won't have to report gifts at all on your tax return. You can give a lot of money away in gifts per year without having to worry about tax ramifications. You have the right to give up to $17,000 per individual per year without having to report it. Few people want to give more than this much money in any one year. However, there are tax ramifications if you go over this amount. If you go over the amount of $17,000 per individual, you're expected to file form 709.

Strive for Success.

The Taxry Store Can Help.

Again, it's best to avoid gift tax reporting by spreading a gift out over several years if possible. This is usually easy for most consumers. Consumers giving large sums of money as gifts are generally giving this money to their children. It's usually easy to give sums of money to children gradually over time rather than all at once. Keep gifts to your children under $17,000 and they will have no tax consequences whatsoever.

If you want to know how does the IRS know if you give a gift, you should be aware of form 709. This is the form that taxpayers use when they are required to report a gift .

Understanding Gift Tax Rules

To get started, you want to understand the gift tax rules. A lot of consumers incorrectly assume that they can give money away with no tax ramifications. After all, they've already paid income tax before giving their own money away. Unfortunately, the IRS does place some restrictions on how much an individual can give away without tax consequences. This is why you should know how does the IRS know if you give a gift. The IRS wants to collect any taxes that consumers owe. This is why the IRS will look out for unreported gifts.

The good thing to be aware of is that the person you give a gift to won't have to pay any taxes. They will be able to use all the funds tax-free. This is advantageous. Obviously, you don't want to increase your friend or family member's tax liability. The IRS won't expect this person to report the gift or pay taxes on the money.

In fact, according to the tax rules, you probably won't have to pay any taxes on the gift either. You only have to pay a gift tax in certain situations. While these situations probably won't apply to you, it's still good to know about rules regarding taxable gifts.

Taxable gifts

Certain gifts are taxable. As a general rule, you'll need to pay taxes on any monetary gift over $17,000 to one individual in one year. Not only do you not have to pay gift tax on such gifts, but you won't even have to file a gift tax return.

You only have a gift tax return filing and payment responsibility if you give more than $17,000 to one individual in a year. Although you may be required to pay taxes on gifts over this amount, you won't necessarily be. There is also a lifetime exclusion amount. You should be aware of what both annual exclusion and lifetime exclusion mean when it comes to gift taxes.

Annual exclusions

The annual exclusion amount in relation to gifts is $17,000. This is the amount over which a gift tax responsibility kicks in. However, you should know that you can give up to $28,000 to a child if both you and your spouse are giving the money. Each married couple can give $17,000 with no tax responsibility. Then, after $34,000 the gift tax requirements come into effect.

It's best to always keep annual gifts under $17,000. If you want to give more to one individual, consider spreading the gift over multiple years. Even if you give over $17,000 to one individual in one year, you still might get around any gift tax liability thanks to the life exclusion.

Life exclusion

In addition to the annual exclusion, there is also the life exclusion to be aware of. The life exclusion is set at $12,060,000. This means that you can go over the annual exclusion in one year and not owe gift taxes as long as you haven't given more than $5,430,000 in gifts over the annual exclusion amount throughout your entire lifetime.

Obviously, the amount of $12,060,000 for the life exclusion amount means that most Americans will never have to pay a gift tax. However, you do have to file a special gift tax form if you avoid gift taxes because of the lifetime exclusion. You need to file a special form any time you give more than $15,000 to one individual in one year.

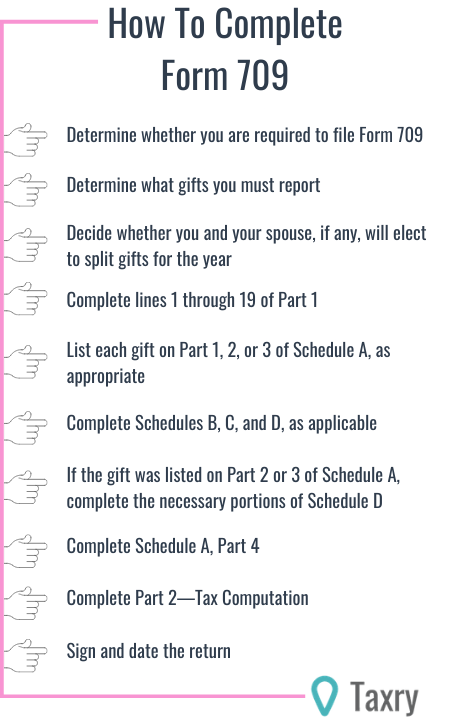

Filing Form 709

Form 709 is the form that you'll need to submit if you give a gift of more than $17,000 to one individual in a year. On this form, you'll notify the IRS of your gift. The IRS uses this form to track gift money you give in excess of the annual exclusion throughout your lifetime. Therefore, you'll be asked for the amount of the gift and the amount over the annual exclusion amount. If you ever go over the lifetime exclusion amount of $12,060,000, you'll then need to start paying the gift tax.

You don't want to neglect to file form 709 if you're required to. If you don't file this form, you could be subject to penalties by the IRS. You'll also be charged more penalties on interest on any gift tax that you do owe if you owe gift tax.

Tax audits

When you get audited by the IRS, the IRS has the right to access your financial records. This doesn't just include records regarding your income. It also includes records regarding your bank account. While giving a gift won't impact your income, it could become apparent in your bank statements. If you've transferred money directly from your bank account in giving your gift, the IRS can find out about this.

The IRS is generally unlikely to find out about a gift normally. However, if you get audited, the IRS will know. You could then be subject to penalties for not reporting the gift. You could be subject to back taxes. and interest on any money you owe. That's why it's generally important to report your gifts properly. This is the best way to avoid trouble with the IRS.

Audits aren't just expensive and time-consuming. They're stressful as well. If you get audited, you may need to hire a CPA to represent you. This can be very expensive. Otherwise, you will have to devote a good deal of time to handling your audit yourself.

Consequences of an unreported gift

The consequences of an unreported gift that is found out are unpleasant. Not only can you be subject to penalties, but you put yourself on the IRS's radar. This means that you'll be more likely to get audited again down the road. Undergoing an IRS audit is definitely an unpleasant experience that you want to avoid. Therefore, make sure you're staying on top of all your gift reporting responsibilities.

Making sure you won't owe any gift tax

The best thing to do is to take care that you won't owe any gift tax. In fact, it's best to also make sure that you don't have any gift tax responsibilities. Again, you can easily avoid gift tax responsibilities by giving less than $17,000 in a year to one individual. You can rely on your spouse to give half of a gift and give up to $34,000 to a child without having to let the IRS know.

Remember that audits are a real possibility when it comes to how does the IRS know if you give a gift. You need to give your money carefully to avoid trouble with the gift tax. If you have considerable wealth that you want to give away, be aware of the lifetime exemption amount. This amount is currently set at $12,060,000. Avoid giving more than this amount over the annual exemptions throughout your lifetime.

Having to pay the gift tax is an unfortunate situation. In a sense, you're wasting money when you make yourself subject to this tax. You need to realize that you already have to pay income taxes on the money you earn and then give away. The gift tax, therefore, is almost like having to pay tax twice on the money you earn. This means that you should do everything possible to avoid being subject to the gift tax. You don't want to have to pay the IRS any more than necessary. Plan your giving carefully and you should be able to find a way around the gift tax.

In Conclusion

Keeping the above mentioned information in mind whenever you give a gift is important. This way, you make sure you take care of all requirements when tax day comes along. You understand how does the IRS know if you give a gift. That means you should be especially careful to report a gift as necessary.

Giving monetary gifts is a generous thing to do. You can improve the lives of your friends and family by sharing your wealth. Many consumers need to give a gift at some point. That's why they need to know what the tax ramifications of gift giving are.

With this information, you can minimize your tax liabilities. Rest assured that you're unlikely to owe any gift tax unless you have a great deal of wealth to share. Yet it's still good to enjoy the peace of mind of knowing you're doing things correctly. Dealing with a penalty after the IRS discovers an unreported gift is no fun and costs you money. Track your gifts carefully and report them properly and you'll be good to go!