Why Is It Good to File Your Taxes Early?

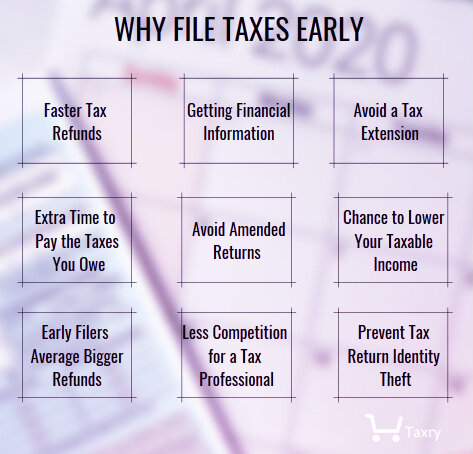

When taxes are due in April, many people will wait until the last minute to file. There are many reasons why you want to file your taxes early.

When Can You File Your Taxes?

While you can file as early as the end of January, you may not actually be ready to file that early. Employers have until January 31 to mail out W-2 forms and the other data that is important for a tax filing. The same deadline also applies to 1099 forms for independent contractors. Those that own certain entities, such as an S-corporation or partnership, may not get tax forms for business income until March. If you are going to have a more complex return then you do have to wait for the paperwork. Even those who do have their paperwork before the end of January shouldn’t be too hasty and make sure you have time to get it done right. While you can file without a W-2, it’s advisable to wait. If you are looking to file your taxes early and your W-2 hasn’t shown up then you may be able to file using Form 4852.

Why Filing Early Makes the Most Sense

For the 2020 tax season, the window opened on January 27 and you can now file your taxes early. The IRS says that most refunds are issued within 21 days. Filers that are claiming the Earned Income Tax Credit may not get refunds until the middle of February. Even if you don’t file early, it helps to get the preparation started so you can avoid a big headache. There is no penalty for filing early once the IRS starts accepting federal returns.

Faster Tax Refunds

A very common reason to file taxes early is to get your tax return faster. Filing your tax return electronically with direct deposit into a bank account is the quickest way to get the refund. If you are getting a paper return, it can take several weeks longer to get your refund so it’s better to e-file.

Extra Time to Pay the Taxes You Owe

If you need to pay money then you may still want to file your tax return as soon as you can. If you submit the return in the middle of January, you don’t actually have to pay the taxes you owe until the deadline in April. Preparing your Form 1040 earlier gives you time to arrange payment. This extra time can be helpful to taxpayers who need to find out exactly how much they owe.

Getting Financial Information

If you are expecting a big life change, such as returning to college or purchasing a home, then filing your tax return earlier can help you get essential information. College students need to use the information on their Form 1040 to apply for financial aid. Prospective homebuyers usually have to show their completed tax return to show proof of their household income. Getting your tax return done earlier, whether you expect a refund or owe money, will give you a head start on any paperwork you need for certain processes.

Get All the Tips You Need for a Successful Tax Season. Meet Taxry Store.

Avoid a Tax Extension

Filing your return early means that you won’t need to file for an extension. Extensions are usually needed because of disorganization instead of financial need. Some people wait to the last minute and then need more time than they think to look for any additional deductions and gather receipts. If you push the process too close to the deadline then you increase the likelihood that you will need the help of a professional to compete your return. If you file an extension but don’t pay what you owe then the IRS charges you penalties and interest on the debt until you pay it in full. Preparing your tax return earlier in the year helps you avoid being in this situation.

Prevent Tax Return Identity Theft

If a criminal gets access to your Social Security Number then the thief has everything necessary to file a return in your name. The purpose of a thief filing a fraudulent tax return isn't to pay the taxes you owe but instead to pocket your refund. This scam starts early in the tax season before a lot of taxpayers start to file. While you should take every precaution to keep your Social Security Number secret, if you file your taxes early then you can prevent this from happening and make sure you get the refund you deserve.

If you can’t file your taxes early, there are other ways to deter fraud. The IRS can offer a transcript service that allows you to review activity on their record. While this method doesn’t prevent any tax fraud, it can allow you to proactively address the problem instead of finding out about the fraud when you file your return. There may also be the option of using an identity protection PIN that gives another layer of security against fraud. In past years, the federal government only gave PINs to those who were victims of tax identity theft in the past. However, certain states are now eligible for a PIN even if you aren’t a victim of identity theft. When do you request a PIN, you have to have one every year to file. If you are eligible for a PIN, a PIN can be a good way to deter any fraudulent returns. Otherwise, filing your taxes early is the best option.

Early Filers Average Bigger Refunds

It’s important to remember that a tax refund isn’t free money and getting a larger refund from the IRS means that you have been lending the government money without interest all year. If you do receive a refund that is more than a few hundred dollars then you should work with a professional to adjust withholdings on your W-2. When you fix your withholdings then you get larger paychecks and it feels like you got a raise. Now if the government does owe you money then you want to make sure that you are getting what is yours. Filing early can help you do that. IRS data shows that taxpayers who file by the end of February are getting a larger refund than those who are filing later. If you know you are getting a refund then you are more likely to file sooner so this is part of the reason why it seems like early filers are getting a larger refund. However, another reason is that the sooner you file, the more opportunity you have to make sure you are claiming all the tax credits and deductions you are eligible for. This takes more time and documentation than just doing the standard deduction.

Less Competition for a Tax Professional

You may have found this out the hard way but it can sometimes be hard to get a good tax professional during peak tax time. If you haven’t set up an appointment with a professional by the middle of March, it’s possible that you will need to file an extension. Some tax professionals may even charge more to do your taxes as the deadline gets closer. The best way to avoid all this is to get an appointment with your preferred tax professional as soon as possible.

There are many benefits of hiring a tax professional that you may want to consider. Filing your taxes on your own can be very time consuming. You can save time and money if you work with a tax professional since your tax preparation fees can be deductible. Filing a federal tax return can be complicated and confusing and the law is constantly changing. When you work with a professional, you can find credits and deductions that you may have otherwise missed. Working with a professional can help you avoid mistakes. In the event that you do get audited, a tax professional can help you through the process and deal with the IRS directly.

Avoid Amended Returns

When you start early, it gives you more time to make sure you file an accurate return. An inaccurate return will mean that you will have to have an amended return. If you have an amended return, it could invite an audit. There are some things to pay attention to in order to make sure you file an accurate return.

Mistakes in Documents: Be sure to check your income statements, including 1099s, interest statements, W-2s, and other documents used to justify a deduction. Banks, financial institutions, and companies can all make mistakes so you want to catch them before you file.

Forms That Come Late: When you file your taxes early, it can sometimes cause you to miss documents that arrive late. Be sure to check that you do have all your documentation before you drop your return off or click send on the return.

Tax Law Updates Not Being Reflected in Forms: Any legislation that is passed before April 15 might not be incorporated into tax software or paper forms. Be on the lookout for any changes that you may miss. In this case, it’s likely okay to file an amended return.

Be Honest: If you do have to amend your return, don’t just correct things that are going to be to your advantage. Correct everything and anything that is wrong.

Chance to Lower Your Taxable Income

The tax-filing season doesn't end until mid-April, which is helpful if you want to lower your taxable income. While the calendar year may be over, there is still a chance to reduce what you owe if you start the process early. Start running the numbers through some tax prep software. If you don’t like the results, you still have a chance to reduce what you owe and bulk up the refund. For example, opening a health savings account or making a contribution to an IRA could reduce your taxable income and this can be good news for you.

Avoid Stress during This Time

Tax time can be stressful enough and when you file your taxes early, you can remove some of this stress. You can reduce stress by getting it out of the way and getting your refund quicker. Having more time to maximize your refund can also take some of the stress off. Once you file your tax return you can rest easy knowing you have met the deadline and you can focus on living your life.

What about Quarterly Taxes?

Filing your taxes early doesn’t matter as much if you are going to pay quarterly taxes. Quarterly taxes are how self-employed individuals have to file taxes through the year if your income exceeds a certain amount. Your four tax payments are made every three months and are designed to cover Social Security and your income tax. If you aren’t sure if you will need to pay quarterly taxes, it’s best to reach out to a professional. If you wind up owing a sufficient amount and you didn’t file your taxes quarterly then you may have to pay an underpayment penalty. Quarterly taxes are due in April, June, September, and January.

How to Get Started on Your Taxes

Even if you don’t want to file your taxes early, it helps to start preparing as soon as you can.

As tax time approaches, you will get a lot of documents in the mail. There are some forms that you have to pay attention to. Your W-2 form comes from your employer and shows the amount you earned and the amount of money that was withheld from your paychecks. If you have worked part time or full time then you will get this form.

A 1099 form is to report income from a source other than an employer. You will get this form if you are a freelancer or contractor, or if you get income from real estate. There are other 1099 forms you will see. A 1099-INT form is for any interest you get from saving accounts or any investment dividends. You will get a 1098 form for any interest payments you made on student loans or on your mortgage. You may not need to submit these documents to the IRS but keeping them in one place can make it easier to file.

Filing Your Tax Returns

You have three possible options for how to submit your forms.

This is the preferred method. It’s easier, faster, and you are less likely to make mistakes when your forms are submitted electronically. There are many different software programs that will allow you to submit your taxes for free. The IRS provides a list of software programs to use for free depending on how much you make. While you can file your federal taxes at no cost, many will also let you e-file the state returns for free if your income doesn’t exceed a certain amount. The programs ask questions about your lifestyle to help you find any credits and deductions you are eligible for.

There is also the option to fill out some paper forms and then mail them to the IRS. The address where you need to mail these forms will vary by state but is found on the IRS website. However, when you mail in your forms, it can take about six to eight weeks for the form to be processed. This can delay your refund if you are owed one.

Authorized tax preparers have the authority to e-file for you. You work with these paid professionals, such as accountants, to complete the taxes and submit the forms electronically. You can also use volunteer tax services to help you submit the forms for free.

Determining Filing Status

Once you have your paperwork and know what method you are going to use for your filing then you will need to make sure you have the right filing status and this is a very important step.

Single: Use this status if you haven’t been married or if you are widowed or divorced. You wouldn’t typically file as single if there is the option to file as head of household.

Head of Household: You are eligible for this status if you aren’t married but you paid at least half the cost of maintaining a home and living with a qualifying person. A qualifying person could be someone you financially support, as long as they meet the requirements.

Married Filing Jointly or Separately: You are eligible to file as married if you were living together with a legal spouse recognized by your state as of December 31st. Even if you weren’t living with your spouse but weren’t legally separated, you can use this status.

In Conclusion

It can be a good idea to file your taxes early, as long as you already have all your paperwork. When you file your taxes early, you get your refund faster or have more time to prepare to pay your taxes. One of the other big benefits is preventing tax fraud. Even if you aren’t going to file your taxes early, it helps to start preparing as soon as you start to get your paperwork. Once you have your paperwork, chosen your method of filing, and know your status, you are ready to go.